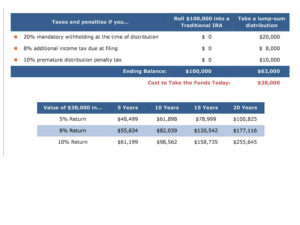

While a lump-sum distribution can be tempting, it can also cost you thousands of dollars in taxes, penalties and lost growth opportunities…money that will not be available for future use in retirement.

Let’s assume that you’re under age 59-1/2 and in the 28% federal income tax bracket. For each $100,000 you have in a retirement plan with a former employer, these are the hypothetical results of rolling the funds into a traditional IRA or of taking a lump-sum distribution.

NOTE: The above is a hypothetical example for illustration purposes only and assumes that one of the exceptions to the premature distribution penalty tax is not available. In addition to the federal taxes illustrated above, state tax may also be payable. This example is not indicative of any particular investment or performance and does not reflect the fees and expenses associated with any particular investment, which would reduce the performance shown above if they were included. In addition, rates of return will vary over time, particularly for long-term investments.